Now here’s a task for you. Click on the link here to Economist’s View, probably the most widely visited economics blog and aggregator of all things economics-related on the web. Go to the Google Search function at the top and type in ‘Peak Oil’ restricting the search to ‘This Site’. What do you get? The answer: very little (relatively speaking). Around 98o results, compared with a total of 9,500 for the word ‘Greece’.

Glance a couple of results down and you will see one headline titled “Peak Oil is Stupid”. If you follow the link, you will end up at a post by Tim Haab, blogger at Environmental Economics and an economics professor at Ohio State University. What does he have to say about Peak Oil:

Must be time to update my semi-regular ‘peak oil is stupid’ rant. So here goes…

I don’t care when oil (OR COAL) peaks, I care when we run out, which we won’t because, as production declines, prices WILL rise. As prices rise, people WILL figure out alternatives. They might not be happy alternatives. They might not be as productive alternatives. They might not support the same lifestyle to which we are accustomed. But there WILL be alternatives, forced by higher prices–and no other mechanism is that powerful.

Well that has put the Peak Oilers in their place then! But just in case, let’s see what two of the most famous Peak Oil advocates, Colin Campbell and Jean H. Laherrere, had to say back in March 1998 when they wrote a a high profile article (here) for Scientific American (when oil cost $12 a barrel):

The world is not running out of oil – at least not yet. What our society does face, and soon, is the end of the abundant and cheap oil on which all industrial nations depend.

Furthermore:

From an economic perspective, when the world runs completely out of oil is thus not directly relevant: what matters is when production begins to taper off. Beyond that point, prices will rise unless demand declines commensurately.

Thus from a theoretical standpoint, there is in reality not much difference between Campbell and Laherrere, on the one hand, and Haab on the other.

And now a plea from me: could everyone please keep their straw men in the barn. If we only seek out the views within the opposing camp of the extremists, or the outdated, it is relatively easy to knock down their arguments—but it doesn’t further the debate. Few Peak Oilers now say that one day there will be oil and the next it will be gone; most prescribe, like Campbell and Laherrere, to the idea of peak ‘cheap’ oil and the theory that an oil production growth constraint could increasingly impact on wider economic growth and human welfare.

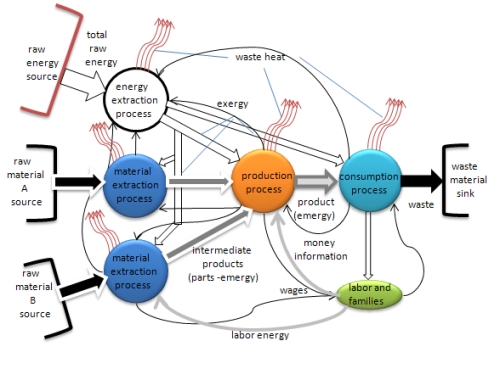

More broadly, I mentioned in my last post that Peak Oil theory would need to overturn the neoclassical economics consensus. Actually, this claim needs refining somewhat, since I wasn’t referring to the theory of neoclassical economics but rather the empirical world view of most neoclassical economists. Mark that these are two very different concepts. Advocates of a biophysical economic view of the world do look at the world differently (look at the graphic below from Question Everything). However, I would argue that the viewpoints are not contradictory; rather they are more like very different artistic interpretations of the same object: the earth system.

The critical point here is that biophysical approaches to economics warn of the tyranny of the second law of thermodynamics: energy and matter will tend to entropy (disorder). From a neoclassical perspective, this, translates into increased scarcity and an upwardly sloping supply curve that moves continually to the left. This contrasts starkly with the neoclassical cornucopian paradigm that as technology advances the supply curve moves inexorably to the right.

Put bluntly, the peak resource advocates see stuff getting progressively more scarce and thus more expensive; traditional neoclassical economists see stuff getting ever more accessible (through the magic of technology) and thus cheaper.

And so back to oil. A strong proponent of the magic of markets and technology over the years has been Daniel Yergin the cofounder of Cambridge Energy Research Associates and the author of a number of highly influential books on the oil industry, the most recent of which—”The Quest”—was a mainstay of my Christmas reading. If you don’t want to read the book, then I recommend an Op-Ed piece he wrote for the Wall Street Journal here.

The article, again, is built around a straw man, in this particular case the ideas of the earth scientist Marion King Hubbert, the father of Peak Oil:

Hubbert insisted that price didn’t matter. Economics—the forces of supply and demand—were, he maintained, irrelevant to the finite physical cache of oil in the earth. But why would price—with all the messages that it sends to people about allocating resources and developing new technologies—apply in so many other realms but not in oil and gas production? Activity goes up when prices go up; activity goes down when prices go down. Higher prices stimulate innovation and encourage people to figure out ingenious new ways to increase supply.

Hubbert is certainly a towering figure in the Peak Oil movement, and Campbell and Leherrere likely built on his intellectual foundations. But schools of thought (at least good ones) evolve, and it is no different with the advocates of peak oil. Thus, if one is to criticise Campbell, it cannot be because he ignores price (even though M. King Hubbert certainly held the market system in little esteem).

If one reads Daniel Yergin after reading the Campbell and Laherrere article, what jumps out at me is how little new is in “The Quest”, despite 12 years elapsing between the two publications. (Is that why Yergin had to reach back decades earlier for his straw man?) For example, Campbell and Laherrere recognised that technology is having an impact:

A second common rejoinder is that new technologies have steadily increased the fraction of oil that can be recovered from fields in a basin—the so-called recovery factor. In the 1960s oil companies assumed as a rule of thumb that only 30 percent of the oil in a field was typically recoverable; now they bank on an average of 40 or 50 percent. That progress will continue and will extend global reserves for many years to come, the argument runs.

Theoretically, these unconventional oil reserves could quench the world’s thirst for liquid fuels as conventional oil passes its prime. But the industry will be hard-pressed for the time and money needed to ramp up production of unconventional oil quickly enough.

If advanced methods of producing liquid fuels from natural gas can be made profitable and scaled up quickly, gas could become the next source of transportation fuel.